Monday, November 5, 2012

A summation of the importance of this election

Sunday, November 4, 2012

Will THIS President Work With Opposition to Help America?

Tuesday, November 1, 2011

Average household income falls 3.2%, then falls to 6.7% under Obama's 'recovery'

Average household income fell 3.2%, THEN FELL to 6.7% under President Obama's proclaimed 'recovery'

Special thank you to Twitter's @bconsdr8 for this link: http://t.co/jX00uinT

Thursday, June 9, 2011

Rick Santorum Enters The GOP Presidential Race

The former Pennsylvania senator Rick Santorum has joined the Republican 2012 presidential race, promising to run on a socially conservative ticket.

Santorum's anti-abortion and anti-gay views could attract support in Iowa, where evangelicals are numerous and where the first of the caucuses is scheduled to be held in February.

Although he has been campaigning in Iowa and other key election states for months, he made the formal declaration that he is standing in an interview with ABC television on Monday morning.

"We're ready to announce that we are going to be in this race and we're in it to win," Santorum said.

He has an outside chance in a field in which is still wide open. Mitt Romney, who stood in 2008, leads the polls but there is little enthusiasm for him so far among grassroot Republicans, especially rightwingers.

In a recent Gallup poll Santorum, 53, was placed well down the field, recording only 2%. But a good showing in the debates, with the next scheduled for New Hampshire next Monday, could change that.

He is a stubborn conservative, insisting, long after even the Bush administration had conceded the point, that there were weapons of mass destruction in Iraq.

Santorum is from a Catholic family in Pennsylvania, his father an immigrant from Italy and his mother a nurse. He has seven children.

He helped pass a bill banning late-term abortions, and caused anger in 2003 when he said states had the right to ban gay sex or other behaviour "antithetical to a healthy, stable, traditional family".

Monday, April 25, 2011

Wednesday, November 3, 2010

Friday, October 29, 2010

Be Represented, NOT Railroaded - Their Voting Record is The Tool ...

of the 111th Congress

January 2009 - September 2010

AFA Action has compiled a Congressional Scorecard that covers 18 votes in the U.S. House and 25 in the U.S. Senate on vital pro-family issues in the 111th Congress.

The Scorecard includes: http://ht.ly/30Svw

* Taxpayer funding of abortion

* Protecting free exercise of religion at publicly supported colleges

* Passage of national health care reform (ObamaCare)

* Restricting free speech in elections

* Confirmation of two controversial Supreme Court justices

(BIG thank you @bconsdr8 on Twitter for this information)

Thursday, July 15, 2010

Where do you stand politically?

political test ...

If a Conservative doesn't like guns, he doesn't buy one.

If a Liberal doesn't like guns, he wants all guns outlawed.

If a Conservative is a vegetarian, he doesn't eat meat.

If a Liberal is a vegetarian, he wants all meat products banned for everyone.

If a Conservative is homosexual, he quietly leads his life.

If a Liberal is homosexual, he demands legislated respect.

If a Conservative is down-and-out, he thinks about how to better his situation.

A Liberal wonders who is going to take care of him.

If a Conservative doesn't like a talk show host, he switches channels.

Liberals demand that those they don't like be shut down.

If a Conservative is a non-believer, he doesn't go to church.

A Liberal non-believer wants any mention of God and religion silenced.

If a Conservative decides he needs health care, he goes about shopping for it, or may choose a job that provides it.

A Liberal demands that the rest of us pay for his.

If a Conservative reads this, he'll forward it so his friends can have a good laugh.

Liberals will delete it because they are "offended."

Friday, May 14, 2010

Across the country, citizens are tiring of the failed policies bankrupting America

New Jersey's Chris Cristie couldn't be more clear with this reporter

Tuesday, March 16, 2010

Protesting Obama's Healthcare pitch in miserable Ohio weather

Pollster JOHN ZOGBY interviewed

... Really Mr Zogby? you should take NOTICE those private sector believing elected officials that are trying to KILL THE PRIVATE SECTOR with the GOVERNMENT TAKEOVER OF HEALTHCARE

Wednesday, March 10, 2010

What have you done lately?

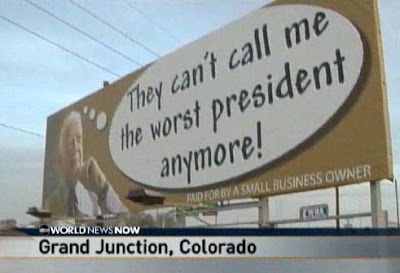

I-15 just south of Salt Lake City.

The cost of a 10 month lease and the artwork was $6500.

We feel that is a reasonable cost to reach out

to 1,000,000 vehicles per month and perhaps motivate their participation and get our country on a sound footing.

Saturday, February 27, 2010

America's Political Climate Disected by John Zogby

.jpg)

Zogby believes Republicans will benefit from the Democrats’ missteps and pick up 25 seats in the House and 10 seats in the Senate.

He predicts Illinois Republican Rep. Mark Kirk will pickup Obama’s former Senate seat and that Sen. Arlen Specter, D-Pa., is vulnerable against former Rep. Pat Toomey in Pennsylvania, but he does not know how much damage Specter’s primary challenger, Rep. Joe Sestak, will inflict.

At the same time, he believes Sen. John McCain, R-Ariz., will successfully fend off his primary challenge from conservative former Rep. J.D. Hayworth.

Zogby also believes former Florida House Speaker Marco Rubio could end up “winning the battle but losing the war” in the Senate race against Florida's Republican Gov. Charlie Crist. Zogby says he is uncertain how well tea party-backed candidates will do in the general election.

Clik link to watch entire interview ...

http://link.brightcove.com/services/player/bcpid14599856001?bctid=68680006001

Friday, February 19, 2010

Thursday, February 4, 2010

Thursday, January 28, 2010

How the GOP can take back Congress in 2010

Visit msnbc.com for breaking news, world news, and news about the economy

Thursday, November 5, 2009

Paying for Washington's Mistakes

Paying For Washington's Mistakes

IBD Editorials: Posted 11/03/2009 06:51 PM ET

Taxation: Policymakers piled up a $1.4 trillion deficit for fiscal 2009. The figure is so high that if Congress were to use the income tax to balance the budget, rates would have to be nearly tripled.

The 2009 deficit was larger than the combined federal debt of the first two centuries of the country's existence. As staggering as that is to the mind, the 2010 deficit projects to be even bigger, roughly $1.5 trillion.

Unless Washington issues another foolish stimulus package or decides it will continue its ill-advised bailout business, the deficits should moderate somewhat. But the debt created by the deficits will still have to be paid. Ultimately, taxpayers will have to satisfy Washington's massive tab.

While it's unlikely policymakers would try to use income tax revenues — which provide almost half of all federal revenues — to close the deficits, it's instructive to see how high the rates would have to go to do that. Data from the Tax Foundation show this Congress and administration are poor stewards of other people's money and are failing their constitutional duty to protect the future of the republic.

The biggest hit in a world in which Washington bridged the budget gap with income tax revenues would be, naturally, on those who have the largest incomes.

The rates for joint filers earning at least $373,601 would have to be almost tripled, from 35% to 95.2%, to help close the 2010 deficit. (See table.) Though the brackets are at different income levels, the rate progressions are the same for single filers.

The rates would not be as punitive in 2012, when the deficit is smaller, but they would still be excessive. Those at the top of the income scale would be moved from 39.6%, the rate that will be reinstated after the Bush tax cuts expire, to 74.1%.

Those on the lowest end of the income scale would not fare much better. Their rates would have to jump from 10% to 27.2% to help eliminate the 2010 deficit, and from 10% to 18.7% to help close the 2012 deficit.

In terms of overall tax bills, the increases are just as alarming.

The average tax bill for a joint return in 2010 will be $7,169. If the deficit were to be closed, however, the federal government would have to have an average of $19,001 from each couple filing jointly (See table). For joint filers with taxable incomes from $50,000 to $75,000, the tax bill would triple, from $4,208 to $12,537.